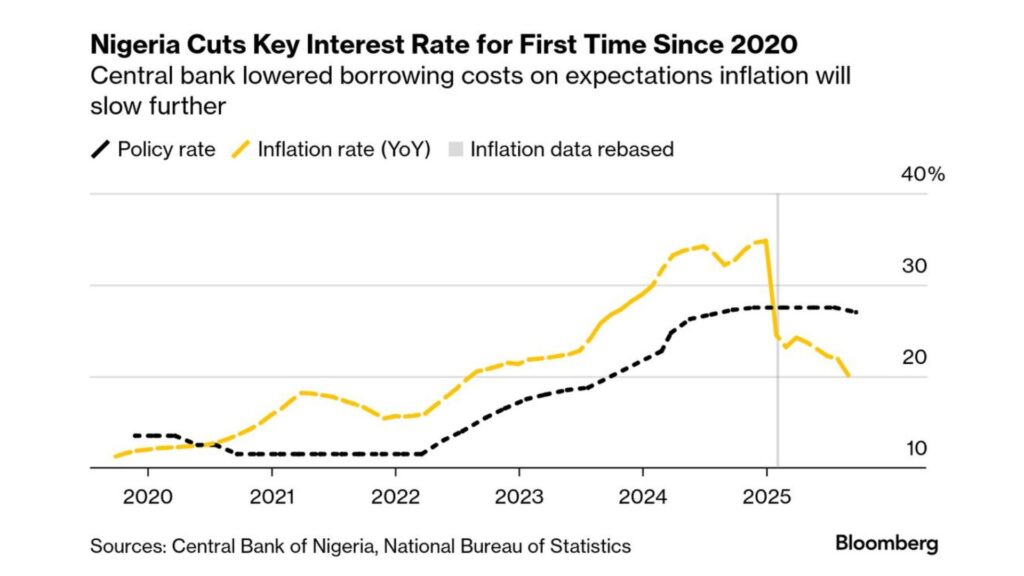

The Central Bank of Nigeria (CBN) cut its benchmark interest rate by 50 basis points to 27% on September 23, marking its first rate cut in five years. The move comes after a long tightening cycle aimed at curbing runaway inflation.

Inflation, which averaged 31% in 2024, fell to 20.1% in August, its fifth straight monthly decline. The naira has gained 3% against the dollar this month, while food prices are stabilizing. The Committee “will remain proactive through a data-driven policy response,” said Governor Olayemi Cardoso, adding that the goal is to bring inflation below 10%.

Policymakers believe reforms launched since 2023 are beginning to pay off. These include scrapping fuel subsidies, liberalizing the foreign exchange market, and ending central bank deficit financing. Inflation expectations are easing, with the IMF projecting average inflation of 24% in 2025 and 23% in 2026.

Nigeria’s economy is also showing signs of strength. GDP grew 4.23% in the second quarter, its fastest pace since 2021. The IMF expects growth of 3.4% in 2025, supported by oil production of 1.7 million barrels per day and output from a new domestic refinery. Services, particularly finance and digital sectors, remain key drivers.

Still, the recovery is fragile. Agriculture faces security and productivity issues, and the economy is exposed to external shocks such as lower oil prices, tighter global financing, and climate risks. The IMF warns the fiscal deficit could widen to 4.7% of GDP in 2025, above official forecasts, while public debt stands at 52% of GDP.

The CBN must now balance disinflation with growth. After raising rates by nearly 900 basis points in 2024, the bank is moving cautiously. Analysts say cuts could reach 700 basis points by late 2026, but much depends on external balances and the government’s ability to secure revenues through tax reform and subsidy removal.

Structural challenges remain. Nearly 46% of Nigerians lived below the poverty line in 2024, while more than 30 million people faced food insecurity. Credit access is limited, especially for small businesses, and high living costs fuel social tensions.

By loosening policy, the central bank aims to support investment and sustain market confidence. Nigeria regained access to international bond markets in late 2024 and secured a credit rating upgrade in April 2025. But the margin for error is slim: a rebound in inflation or a sharp oil price shock could force the CBN to tighten again.