Mauritius’ financial center has surpassed Casablanca Finance City (CFC) to become Africa’s most competitive financial hub, according to the 38th edition of the Global Financial Centres Index (GFCI), published today by the London think tank Z/Yen Group in collaboration with the China Development Institute.

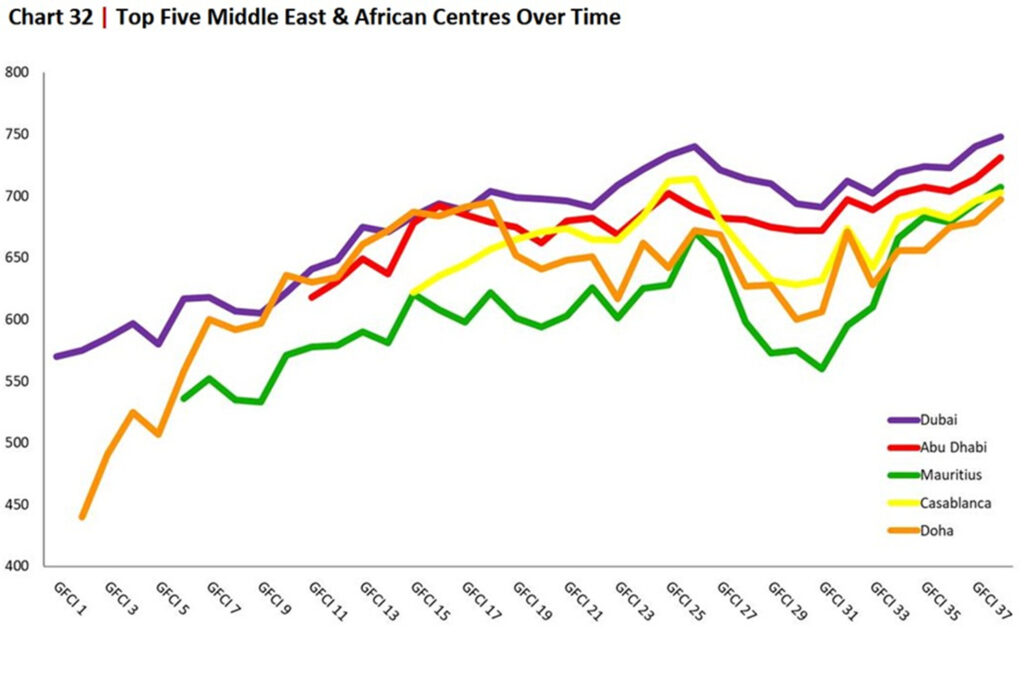

The Mauritius International Financial Centre (IFC) climbed six spots from the 37th edition of the GFCI to rank 52nd globally. It now holds the third position across the Africa and Middle East zone, trailing only Dubai and Abu Dhabi. Strategically located as a gateway between Africa, the Middle East, Asia, and Australia, the IFC has established itself as a prime entry point into the continent. Its ecosystem comprises hundreds of member companies, including financial institutions, regional headquarters for multinational corporations, investment funds, holding companies, and wealth management firms.

The Mauritius IFC contributes more than $1 billion to the nation’s Gross Domestic Product (GDP), representing 8% of the total, and supports over 11,000 jobs. This growth is fueled by a highly competitive fiscal regime, featuring a corporate tax rate of 15% with partial exemptions of 80% on certain revenue streams. This can translate to an effective tax rate as low as 3%. The country also imposes no capital gains tax or withholding tax on dividends, interest, or royalties. Furthermore, strategic sectors like headquarters administration and global treasury activities benefit from tax exemptions, while companies engaged in international trading of goods that are purchased and sold without being physically landed in Mauritius face a 3% tax rate, with profits freely repatriable

Only two of the seven African financial centers listed in the index recorded an improvement in rank: Mauritius and Kigali. Casablanca Finance City held its 56th global rank, maintaining second place in Africa. CFC, with a community of over 200 member companies, precedes Kigali, Rwanda, which climbed seven spots to 65th globally. The remaining African hubs were Cape Town, South Africa, 92nd; Johannesburg, South Africa, 94th; Nairobi, Kenya, 105th; and Lagos, Nigeria, 119th. Four of the centers declined in the global ranking: Cape Town, Johannesburg, Nairobi, and Lagos.

The GFCI ranks financial centers based on their competitiveness, drawing on two main data sources. The first source aggregates and integrates 140 quantitative competitive indices across five categories: business environment, human capital, infrastructure, financial sector development, and reputation. These indices use data from multilateral institutions, including the World Bank, the World Economic Forum (WEF), the UN, and the Organisation for Economic Co-operation and Development (OECD). The second source is a comprehensive survey of 4,877 active participants in global financial markets, such as asset managers, traders, banks, and fintech companies.

Globally, the New York financial center retained the top spot, ahead of London, Hong Kong, Singapore, San Francisco, Chicago, Los Angeles, Shanghai, Shenzhen, and Seoul